The espresso machine hissed, and the sound was usually music to Maria’s ears. But today, it sounded like a countdown. Her little Montreal café was a victim of its own success. A line out the door was a dream, but her single machine couldn’t keep up. She needed a second one, fast. The bank? Their loan application felt like a marathon. She needed a sprint.

This is not just a story about a coffee machine. It is about seizing opportunity and managing cash flow when it matters most.

If you’ve ever faced a short-term cash crunch or a sudden growth chance, you know traditional bank loans can be too slow. The paperwork. The wait. The “no” is because your business is too new.

There’s a better way, and it’s already in your hands.

Let’s explore how a Cash Advance on Future Sales works. We will break down how it fuels growth without the bank loan hassle. You will see how your own payment terminal can be the key to unlocking the funds you need.

What Exactly is a Cash Advance on Future Sales?

Simply put, it’s a lump sum of cash given to your business upfront.

You pay it back with a small percentage of your daily credit and debit card sales.

It’s not a loan. It’s an advance. This is the crucial difference.

- A Bank Loan: Has a set monthly payment. Approval takes a long time. Often needs collateral.

- A Merchant Cash Advance: Payments flex with your sales. Fast approval. Based on your business’s health.

When you have a slow day, you pay less. When you’re booming, you pay back a little more. It aligns perfectly with your business’s natural rhythm.

Why This Beats a Bank Loan for Short-Term Needs

Speed and flexibility are everything for a small business.

Consider the following real-world scenarios:

- A retail shop can buy extra stock at a huge 50% off. They need money right away, not in six weeks.

- A restaurant needs a new fridge because the old one broke down all of a sudden. It depends on weekend service.

- A salon owner wants to launch a marketing blitz to fill quiet weekday appointments.

A bank loan moves too slowly for these moments. A cash advance can provide funds in days.

The top benefits are clear:

- Get funds incredibly fast. Often within 24-48 hours of approval.

- No fixed, scary monthly payments. Your repayment adjusts to your sales volume.

- Simple eligibility. It’s primarily based on your card sales history, not a perfect credit score.

- Use the money for anything. Equipment, marketing, payroll, repairs, you decide.

How Your Payment Terminal Unlocks the Door

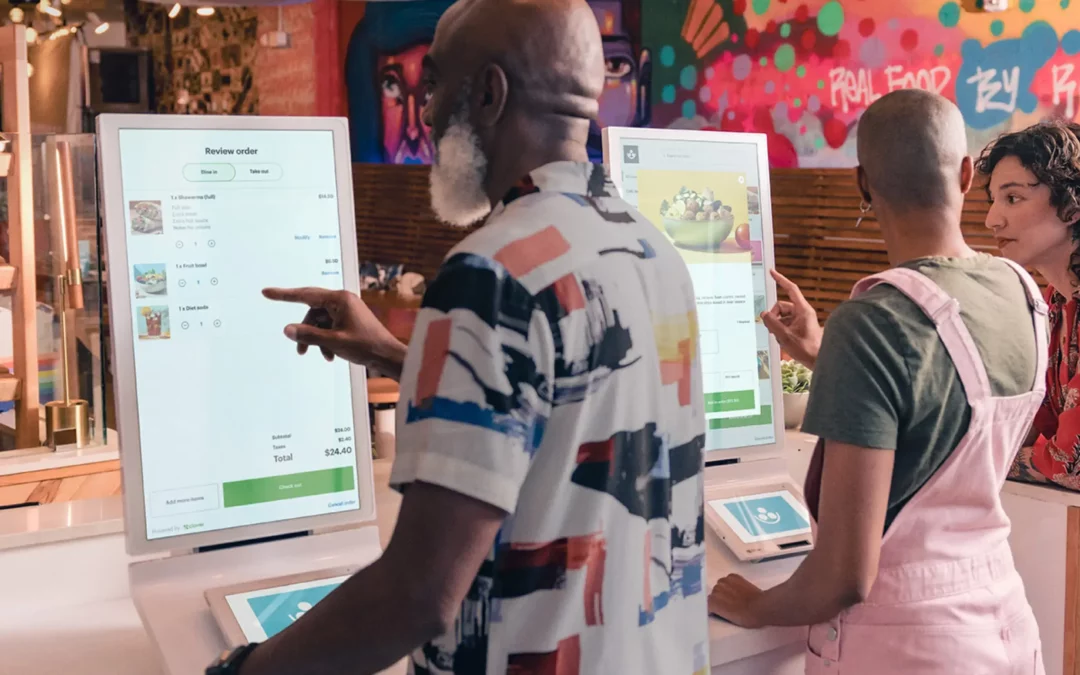

This is where it gets practical. For companies like Bridge Payment, the process is seamless because it’s tied directly to the tool you use every day: your payment terminal.

Your Clover system or other terminal is more than just a way to accept payments. It’s a window into the health and potential of your business.

Here’s how it works step-by-step:

- You Apply. The application is straightforward. It asks about your business and your average monthly card sales.

- We Review Your Sales. The provider analyzes the sales data from your terminal. This shows a clear picture of your consistent revenue.

- You Receive an Offer. You get a certain amount of money with a clear interest rate.

- Funds Arrive. Once you accept, the money is deposited directly into your business account. It’s that fast.

- Repayment Happens Automatically. An agreed-upon percentage of your daily card sales goes towards the balance. It’s effortless and built into your daily routine.

Your terminal isn’t just a tool for making money. It’s a tool for accessing money to make your business stronger.

Is a Cash Advance Right for Your Business?

It’s a powerful tool, but it’s not magic. It’s best for specific situations.

Consider a cash advance if:

- You have consistent credit/debit card sales.

- You need money quickly for a time-sensitive opportunity.

- Your need is short-term, and you have a clear plan for the funds.

Think carefully if:

- Your card sales are very low or unpredictable.

- You need a very large amount of money for a long-term, multi-year project.

The key is to use it strategically. It’s fuel for a specific part of the journey, not the entire trip.

Fuel Your Next Growth Spurt with Confidence

Growth shouldn’t have to wait. A broken piece of equipment shouldn’t cripple your week. A cash advance on future sales is a modern financial tool built for the pace of modern business. It’s fast, flexible, and directly connected to your success.

You have the ambition. You have the customers. Now, make sure you have the funds to bring it all together.

Ready to see what your business could do with a quick financial boost?

Bridge Payment helps Canadian business owners like you access capital quickly and simply. See how our process works and get a no-obligation assessment today.